The US banking system is facing potential instability due to ongoing interest rates rises and a large share of uninsured deposits at some banks. The recent collapse of Silicon Valley Bank (SVB) highlighted the current fragility in the traditional financial system in a report by Cointelegraph

Economists have warned that 186 banks operating in the US are at potential risk of a bank run. Banks can become insolvent if the mark to market value of their assets, after paying all uninsured depositors, is insufficient to repay all insured deposits. Banks have ran into trouble by investing in longer term bonds which have become not profitable with rising interest rates. The recent rise in rates brought down the US banking system’s market value of assets by $2 trillion. A recent report from economists read

“Even if only half of uninsured depositors decide to withdraw, almost 190 banks are at a potential risk of impairment to insured depositors, with potentially $300 billion of insured deposits at risk.”

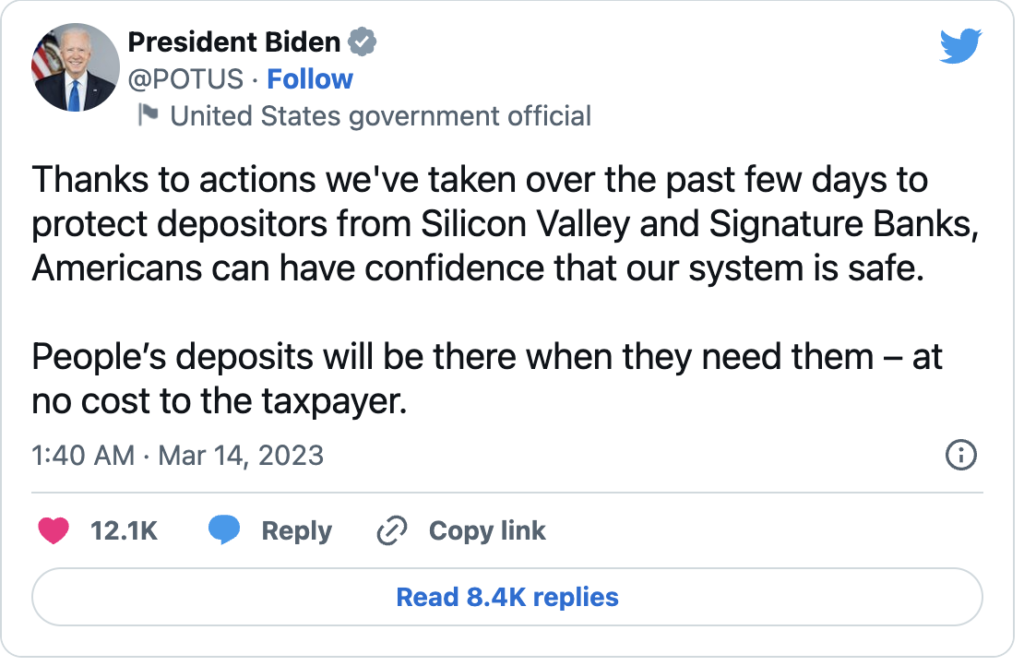

The federal government did step in however covering the bank deposits with emergency funding which seems to have stabilised markets, although many people pointed out from Joe Bidens tweet that what ever action the government takes will cost the tax payer.

Read Full Article Here