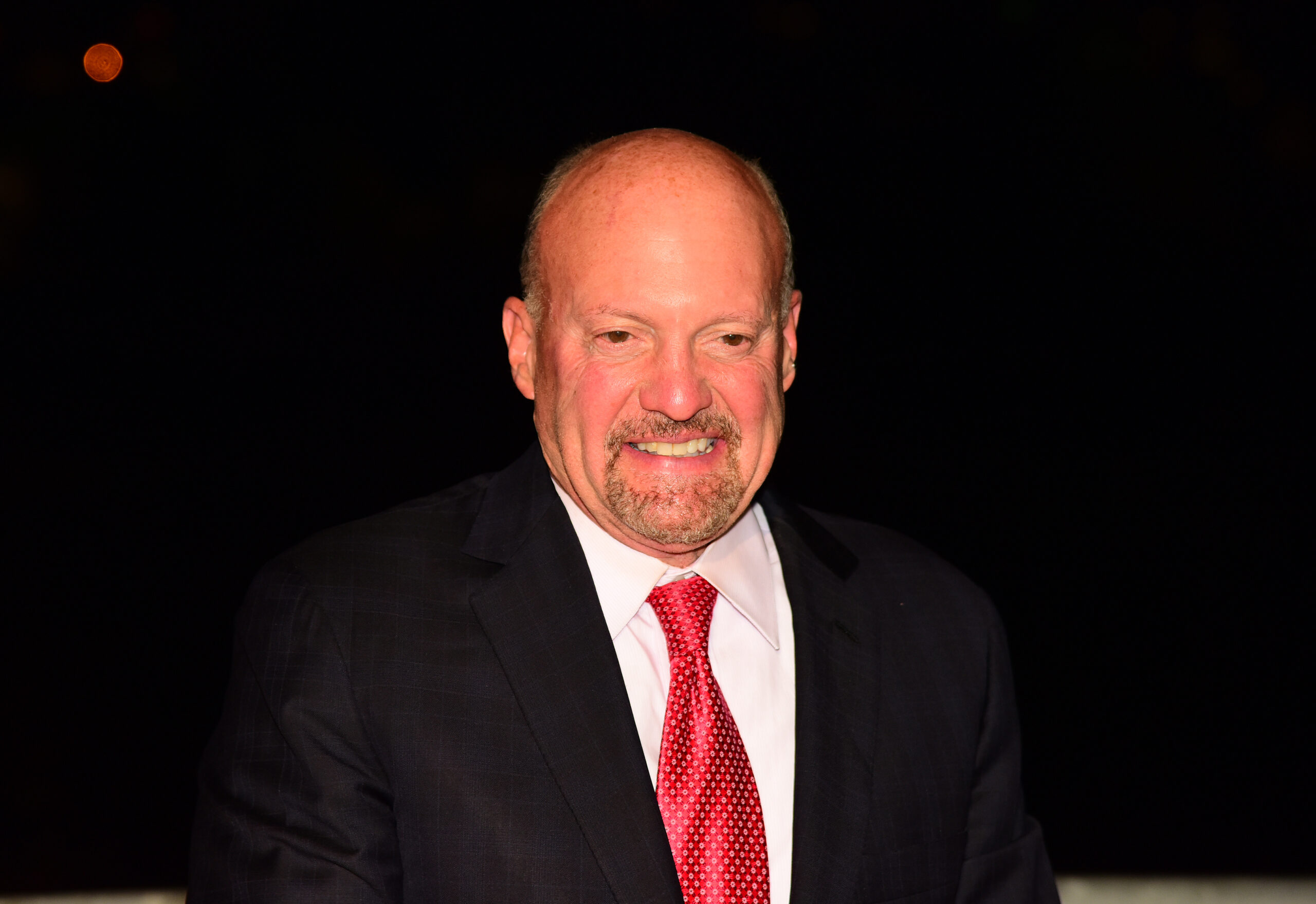

Jim Cramer, the host of CNBC’s Mad Money, recently faced criticism for recommending Silicon Valley Bank to his viewers only a month before the company went bankrupt. His advice was seen as a breach of trust, as viewers had put their faith in his stock tips.

In February, Jim Cramer encouraged viewers to invest in Silicon Valley Bank, citing the bank’s long history of success and strong reputation in the technology industry.

Just a few weeks after investors had put their money into the bank, the institution declared bankruptcy, leaving many people without the money they had invested.

Critics have been vocal in their disapproval of Jim Cramer’s financial advice, accusing him of failing to properly research the stocks he recommends.

Cramer apologized for his comments, acknowledging that he had not done enough research before encouraging viewers to buy the stock. He admitted that he had not taken the time to properly evaluate the situation before giving his advice.

Cramer has become famous in the crypto world for making bad calls. There is a crypto ETF available to invest in called the “Inverse Cramer” which bets against his calls with alarming success.

Before investing, it is important to take into account the opinion of a qualified financial advisor rather than relying solely on the advice of television personalities. This is because the latter may not have the expertise or the experience necessary to make sound decisions. Therefore, it is a good idea to seek professional advice before investing.