Former Coinbase CTO makes $2M bet on Bitcoin’s performance, and bets that due to hyperinflation in the United states that Bitcoin will hit $1m per coin by June 17th – reports Cointelegraph

It’s worth noting that former Coinbase CTO Balaji Srinivasan is known for making bold predictions and has a history of promoting cryptocurrencies. While his prediction of Bitcoin reaching $1 million within 90 days may be seen as highly unlikely by many, it’s not the first time he’s made such claims.

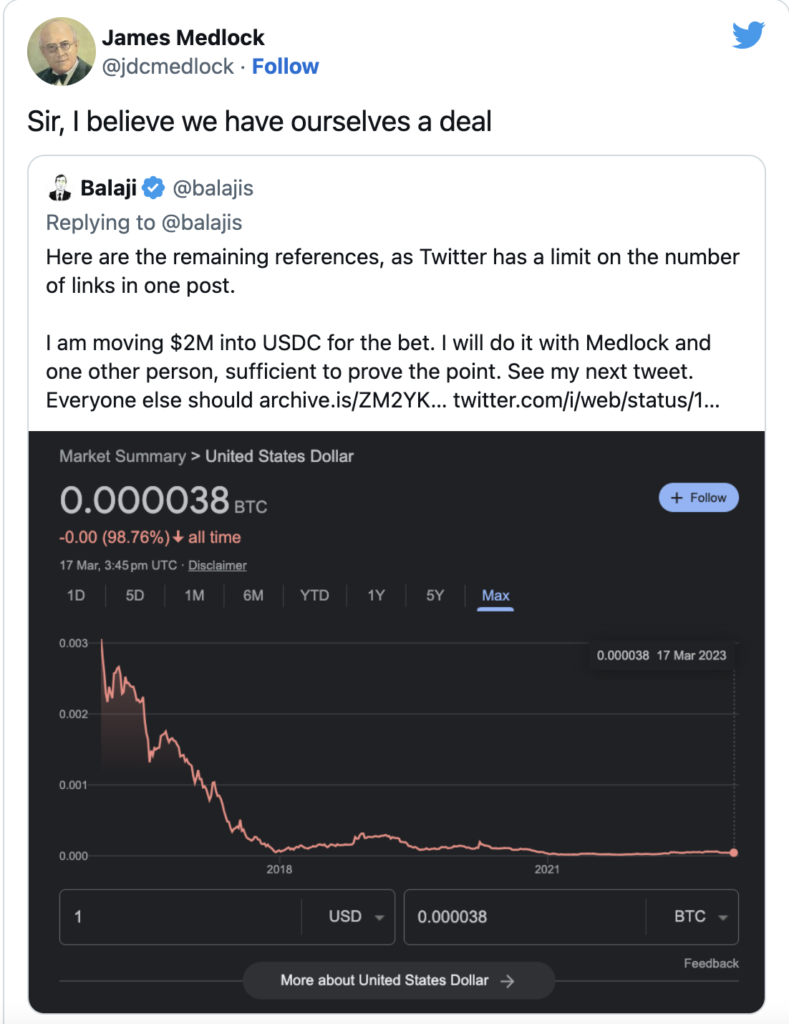

The bet came about via Twitter when an account under the name James Medlock challenged anyone to bet him $1m that the United States would NOT experience hyper Inflation. Within hours Balaji Srinivasan accepted the bet.

In the terms and conditions of the deal, if Bitcoin’s price does not reach $1m by June 17th, Medlock will win $1 million worth of the dollar-pegged stablecoin $USDC and the 1 BTC. BY the same manner if Bitcoin is worth $1 million by June 17th, then Balaji can keep the 1 BTC and the $1 million in $USDC. Srinivasan explained in the tweet:

“You buy 1 BTC. I will send $1M USD. This is ~40:1 odds as 1 BTC is worth ~$26k. The term is 90 days.”

Twitter users helped set up a smart contract with all the betting terms included so everything is fair. Extremely confident about the bet Srinivasan went on to add –

“I am moving $2M into USDC for the bet. I will do it with Medlock and one other person, sufficient to prove the point. See my next tweet. Everyone else should just go buy Bitcoin, as it’ll be much cheaper for you than locking one up for 90 days.”

The bet has certainly generated alot of hype and publicity for the two figures. They both have differing views on the Us ecomomy going forward.

Medlock and Srinivasan made the wager based on their different views of the U.S. economy’s future amid ongoing uncertainty regarding the country’s banking system and the likelihood of hyperinflation in the United States. While Srinivasan predicts hyperinflation and a resulting rise in the price of Bitcoin, Medlock is bearish about the possibility of hyperinflation occurring.

Read the full article here